For now, the latest major release of the system is version number 1.29.0, which took about 9 months to develop, from the beginning of describing the mechanics of working with the business analysis phase to the first version release.

Finance Module - from a need to implementation

Throughout fdForge's history, we've launched a multitude of projects in different business verticals. But almost all of those projects had one thing in common, they were either supposed to generate profits, or help solve certain “pain“ of our customers (time savings, control over execution, accounting for leftovers, etc.). If we consider the first category of projects - almost all of them have integration with one or more payment systems. That means that they deal with the money and personal data of users. Such projects need special control over the movement of finances, both for the security of transactions and the predictability of future earnings. Of course, our customers could get all of this data by downloading reports from various systems and merging them into one, but it causes a lot of inconveniences, increases the potential for errors in calculations, and generally violates the very idea of automation.

The financial module of the fdForge platform is designed to record information about the cash flow of each participant in the business process of a specific project. The functionality of this module allows you to do accounting in the form of analytics on accounts and financial documents on the basis of transactions recorded in the system.

In addition, the system lets you see what's coming in, what's going out, what's going in, and all of that stuff broken down by customer, partner, account, or transaction. For example, the system has the ability to break down transactions into different accounts based on their purpose or the currency of the transaction. Based on the data on receipts and payments, the financial module of the system is able to calculate the balance of each account, builds graphs of dynamics on the basis of data on cash flows.

Financial module features:

- Privacy of processed data through the use of impersonal accounts

- Accounts in the system have their own names and identifiers that have nothing to do with a bank or other customer accounts in real life

- Secures data integrity through the use of double-entry

- When a payment is made through the payment system, two transactions are recorded in the system

- The first is a deposit to a specific user's account from a specific payment system (which account is also created in fdForge as a user with the appropriate role)

- The second one is transferring funds from this user's account to the account of the business owner (who also has an account and the corresponding account)

- In general, there can be more than two such transactions, depending on the business process of the specific project, that is, further there may be more transactions of funds transfer from the business account to the account of contractors or partners, and so on

- When a payment is made through the payment system, two transactions are recorded in the system

- Locks funds before they are debited from the customer's internal account to ensure that funds are available in that account at the time of the transaction

- It means that before the transaction, the system checks the availability of the necessary amount of funds in the user's account and blocks this amount at the time of the transaction to avoid double or double withdrawal

- Provides the ability to manually create transactions and set up user accounts in the system

- In addition to the automatic creation of accounts and transactions based on the business process of the specific project, the financial module of the fdForge platform enables manual creation of transactions that map to specific transactions and user accounts

- Has the ability to report and analyze all financial transactions

- The system currently has basic analytics on accounts and transactions that's broken down by user and transaction. Such indicators, for example, are:

- A total turnover of the transaction

- Balance of a specific user account

- Balance of all user's accounts

- List of popular correspondent accounts

- The system currently has basic analytics on accounts and transactions that's broken down by user and transaction. Such indicators, for example, are:

What exactly is included in the version

User accounts

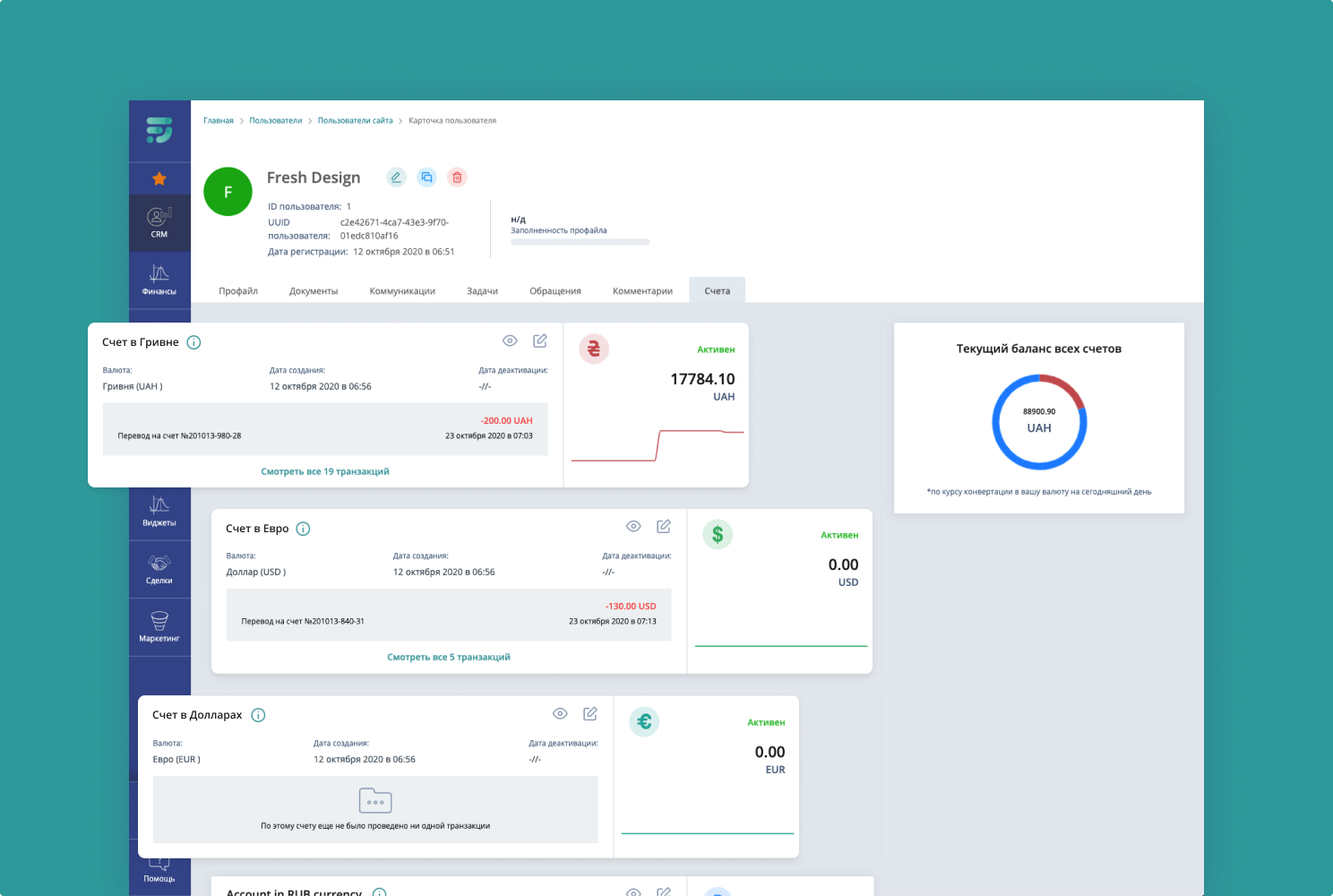

User accounts refer to users' internal system wallets. As mentioned above, accounts are created automatically depending on the business process of a particular project. One account is tied to only one currency, but there is no limit on the number of accounts per user. The system provides the ability to enable crediting for certain accounts, i.e., finding a negative balance on them.

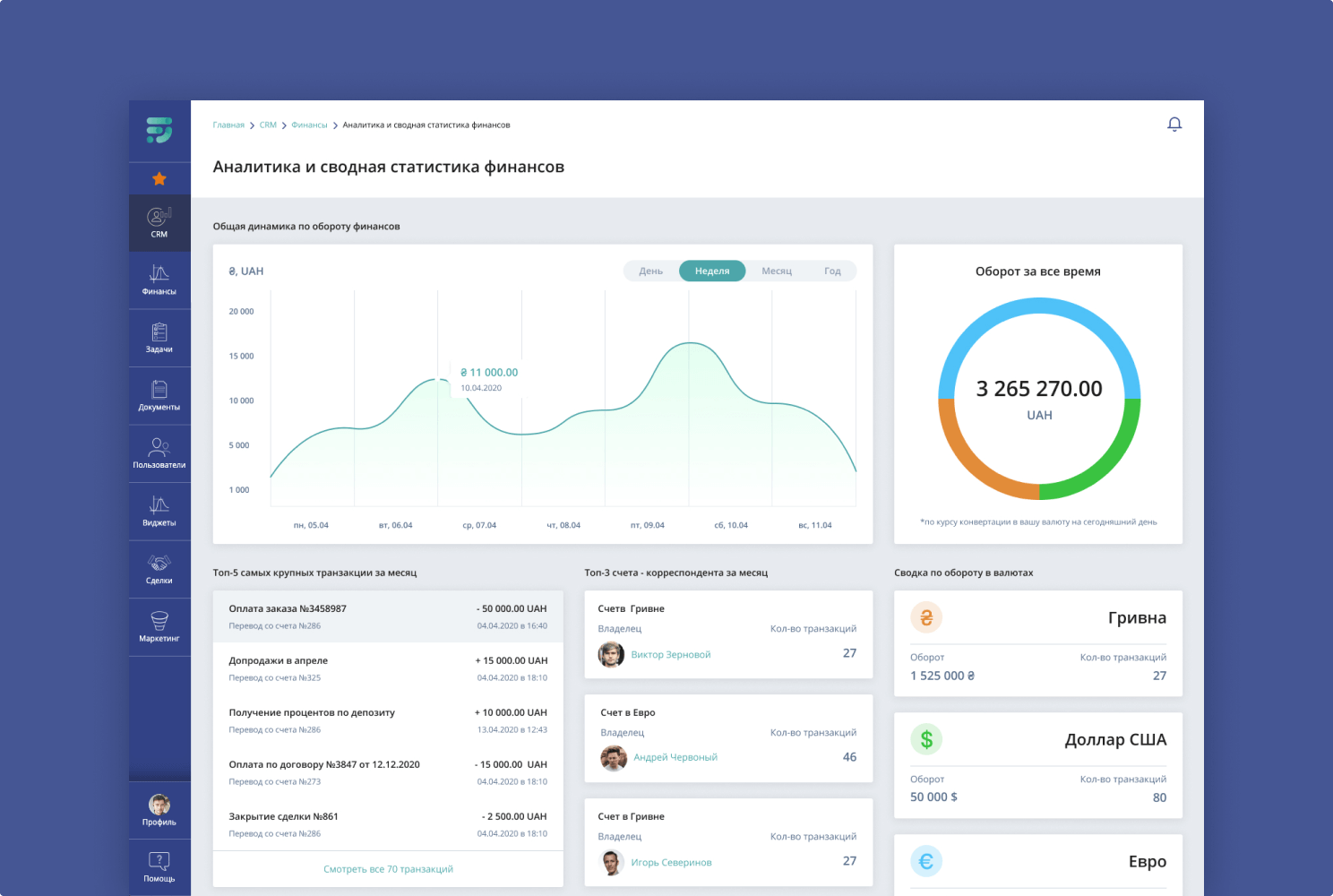

In a user card, you can see a list of all his or her accounts, each account balance, the dynamics of charges/discharges to that account, his or her recent transactions, and the current balance of all user accounts in one currency. Adding this information to the user card makes it more comprehensive and informative, allowing the administrator to better process leads.

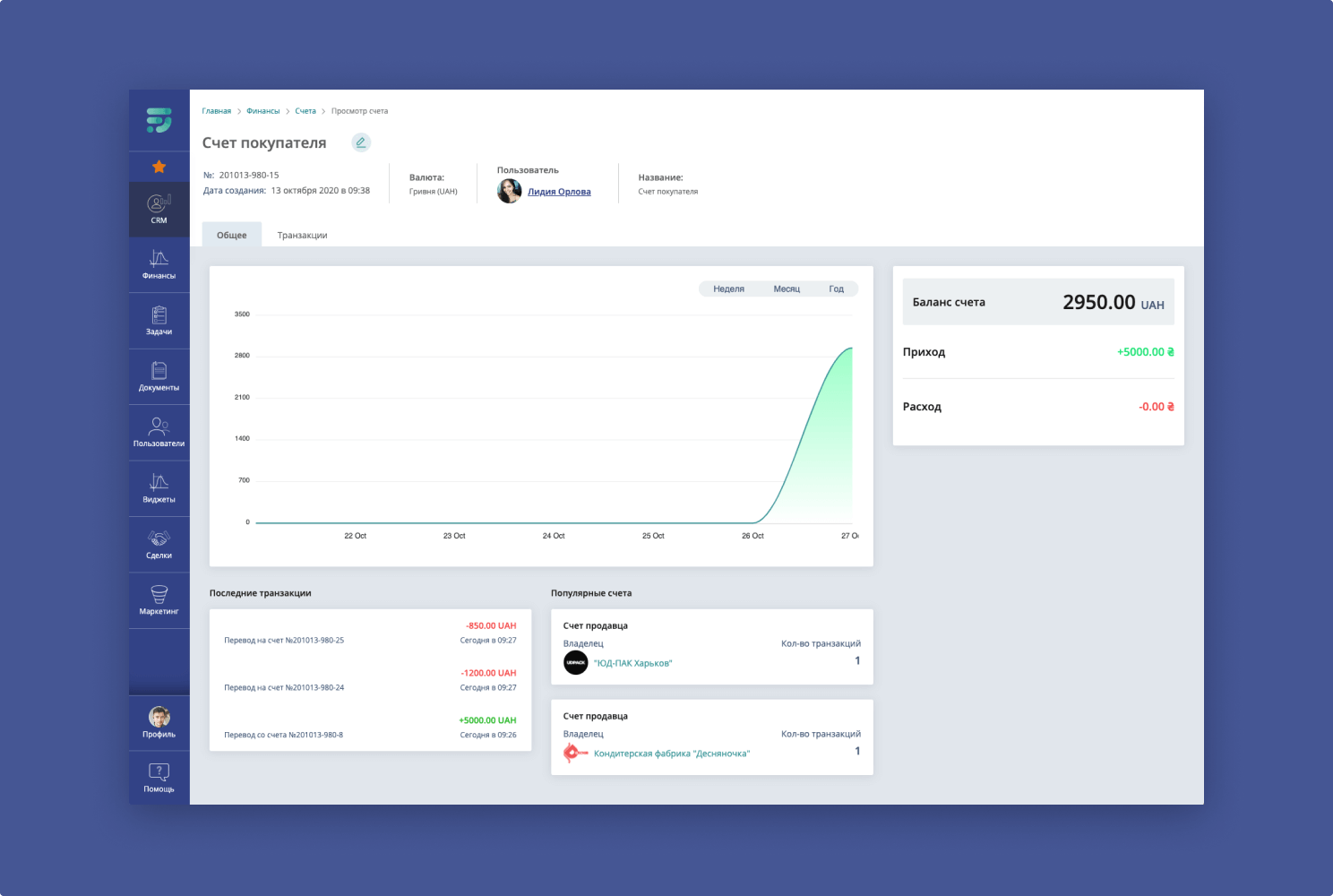

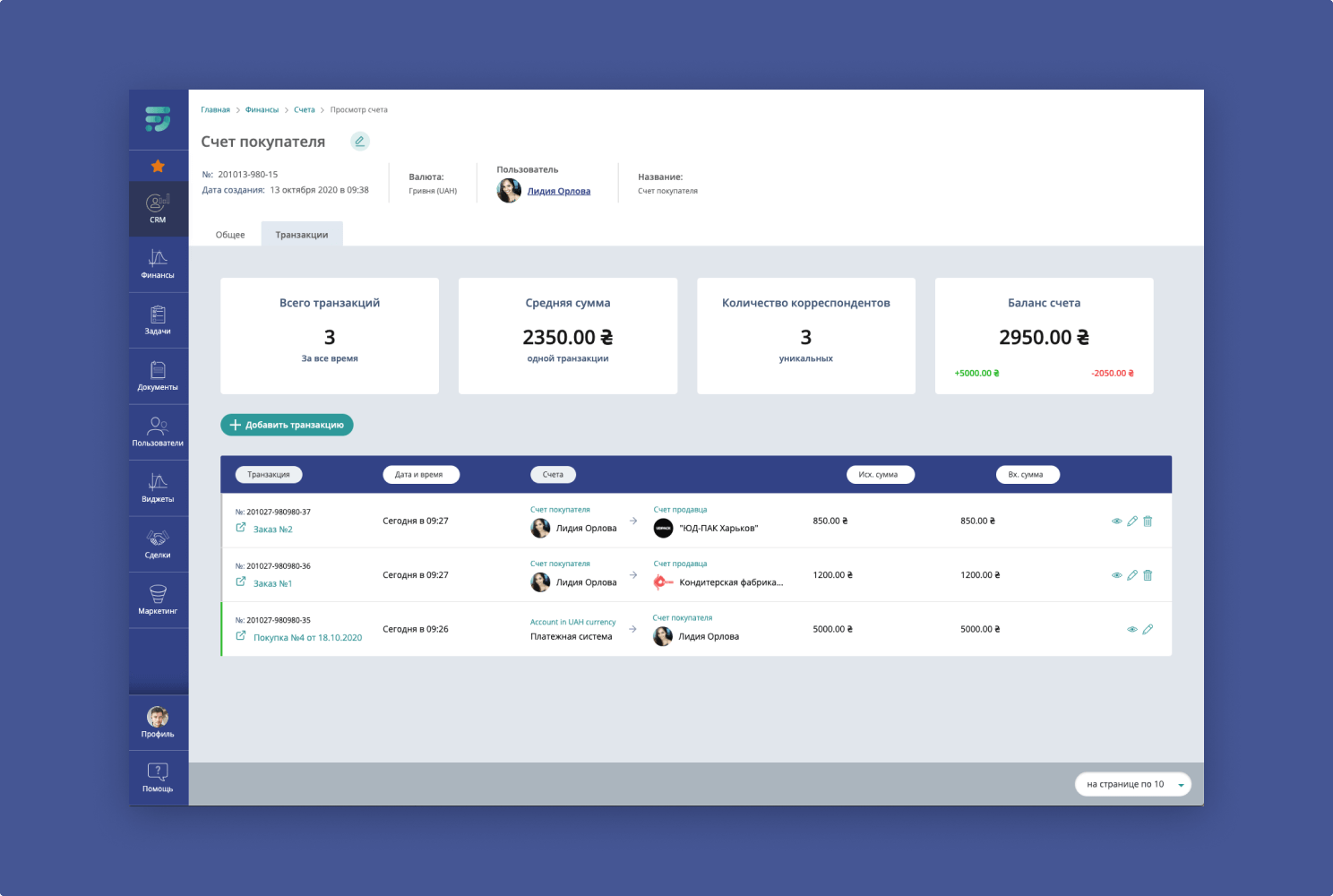

View single account data

Each account has a separate page in the system, where you can see complete information about the account, its balance, total inflows and outflows, accrual trends, and popular correspondent accounts (these are the accounts that have had the most frequent transactions). In addition, you can view a list of all transactions conducted on the selected account and basic statistics on them, such as the total number of transactions, the average amount per transaction, and the number of unique correspondent accounts.

Transactions in the system

Transactions refer to all financial transactions that take place within the system (transfers from one account to another, deposits, withdrawals, etc.).

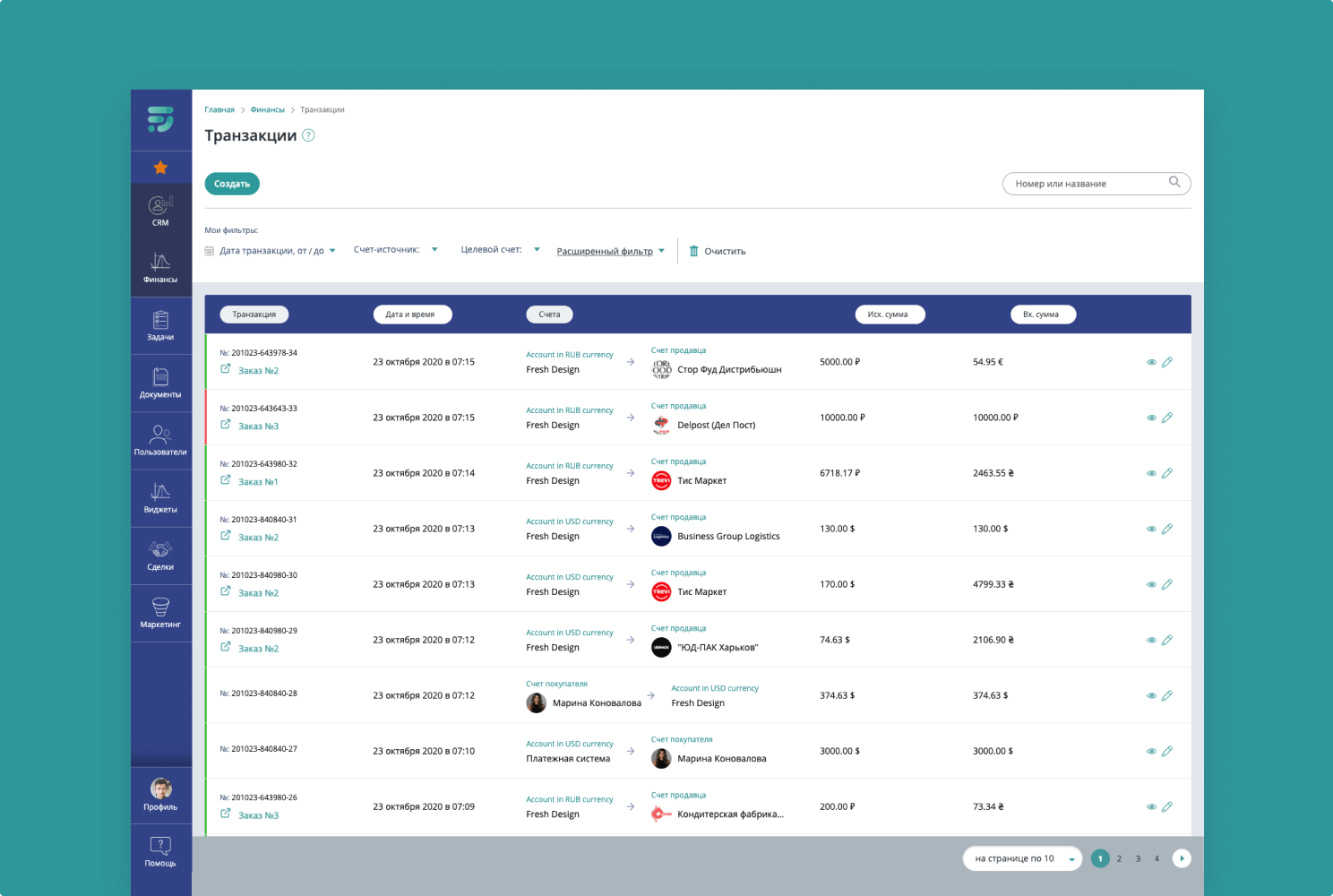

The majority of transactions will be generated automatically and depend on the business processes of the specific project, but the system also allows for manual creation of transactions. However, manual creation is only available if you have the privileges to do so. The automatic creation of transactions is most often tied to the responses of the payment systems integrated into the project.

To make sure there are no stale transactions in the system, each transaction has a specific lifetime, which is set and configurable for a specific project. This lifetime means the amount of time in which a transaction has to be closed, either positively or negatively, since it was created. If the transaction is not closed within the allotted time, it will automatically be cancelled by the system.

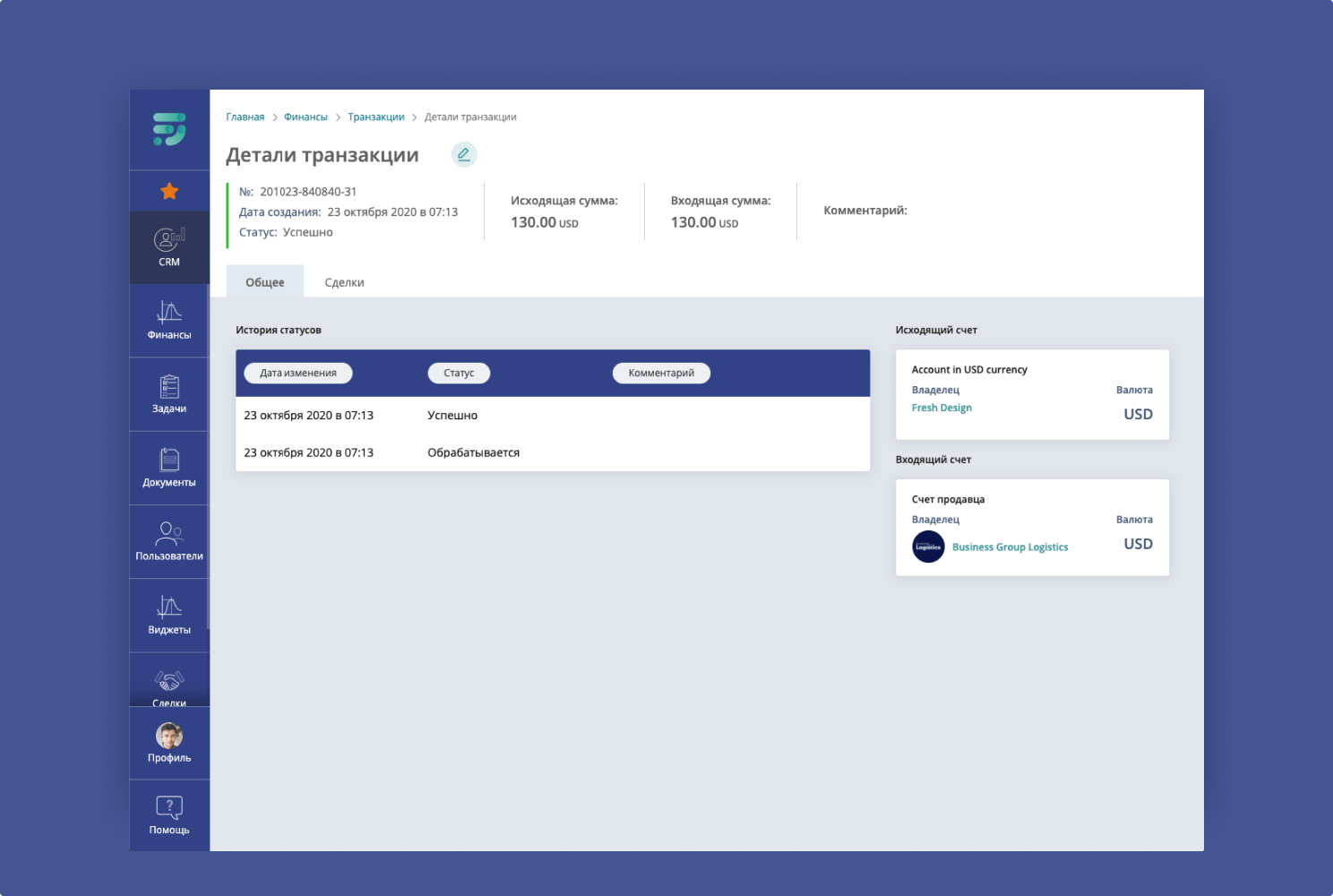

For your convenience, the accounting department has a separate section where you can view a list of all the transactions set up on your project in a single location with search and filtering capabilities based on various parameters. Each of the transactions has a separate page in the system where full information on this transaction is presented - its current status, amount, and data of accounts between which the current transaction was made.

Currency rates and conversions

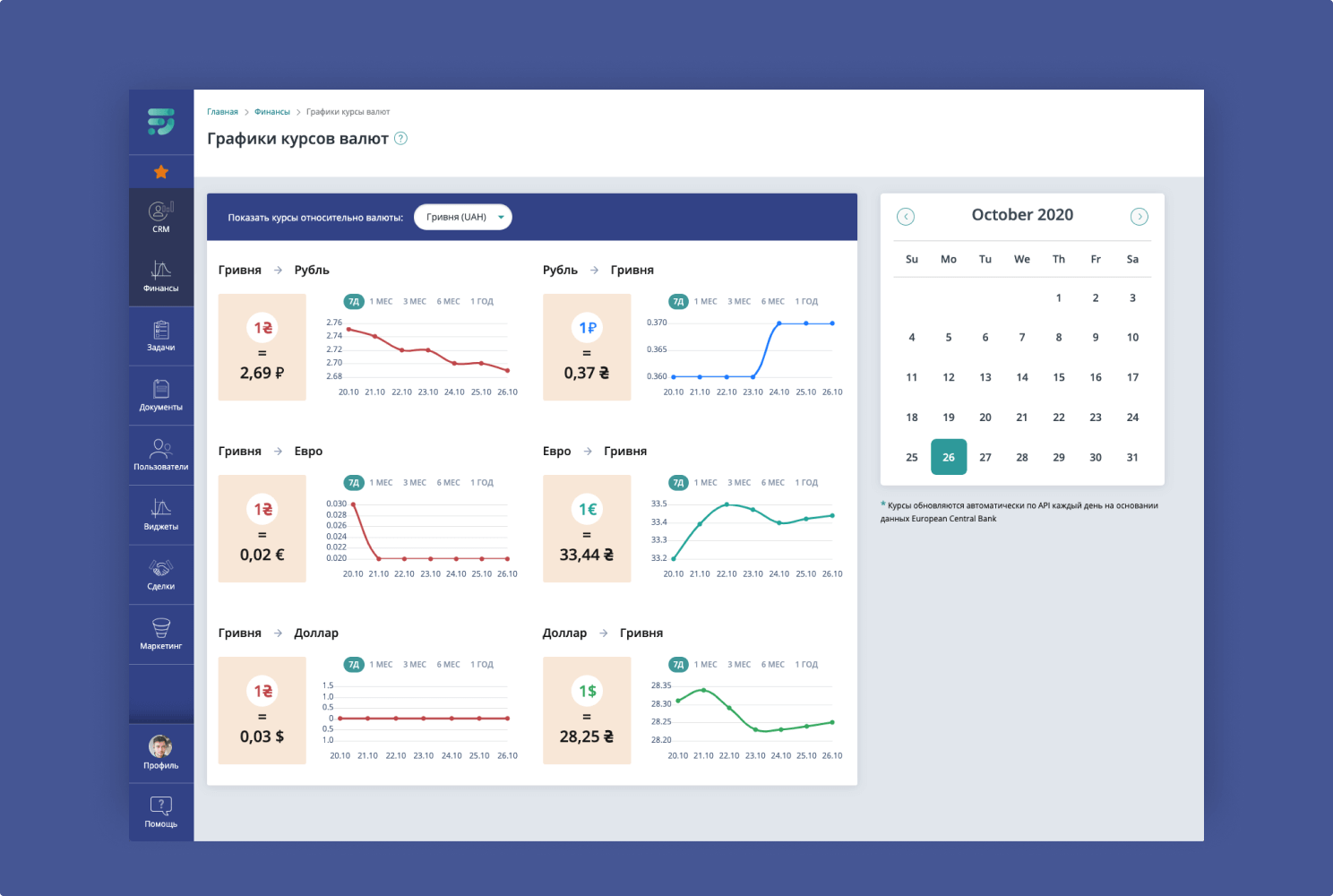

Since the fdForge platform supports multicurrency, the financial module can convert amounts from one currency to another using a rate on a specific date, based on the cross-rates of currency stored in the system.

All cross-currency conversion rates are updated automatically. Admins have the ability to both view the rate on a specific date and use that rate when entering past transactions into the system manually.

Financial analytics and summary statistics

Financial analytics are provided in the system in terms of specific entities - users, transactions, transactions, accounts. The main advantage of this approach is that transactions are not just postings capturing the fact of crediting/cancellation of funds from one account to another, but are attached to transactions between users, thus confirming the transaction and fully participating in the business process of the project.

This type of analytics is critical for business and marketing leadership to predict future earnings, adjust business goals, and execute marketing campaigns.

Application examples

While the finance module was recently released on October 9, 2020, many of our customers have already upgraded to the system and seen its benefits.

A couple of examples of how we use the finance module beyond its original purpose of capturing and storing all of a project's financial transactions are just a few examples.

Usage options:

- Notification of the results of an event performed by the financial module

- For example, after the transaction passing to the final successful status - the user receives push-notification that payment was successful and an email with payment invoice

- Posting of mailing to all users whose transaction turnover exceeded a certain amount

- For example, sending gift or discount promo codes to all customers who spent over 5000 UAH at the service

- Planning next month's income on the basis of the data on the income and expenses in the current month

- Building a sales plan (so far outside the system) based on the analytics of the financial module

- Automatic change of deal statuses depending on the status of the transaction linked to the deal

- For example, the system will consider the transaction closed only after the transaction attached to it moves to the final positive status

- Logging all actions related to project finances

- For example, if there are errors in the payment, it is possible to track at what stage of the payment occurred error and correct it or use this information when communicating with the customer

Results

The main achievements of the implementation of the financial module in the fdForge platform are as follows:

- All financial transactions of the project can be tracked in one system, without the need to switch between their accounts in different payments and banking and summarize all the data manually.

- Always up-to-date information on exchange rates and automatic conversion of funds for multicurrency transactions.

- Building analytics on the financial activity of the project in the context of customers, transactions, company, payment systems, accounts, and other entities involved in the process (the output of aggregate information with charts and tables).

- Support the integrity of the data stored in the system since any financial transaction doesn't come “t come from anywhere “ and doesn't go “t go anywhere ”. A transaction always has a sender account and a beneficiary account, and each of these accounts, in turn, is tied to a specific user. The transaction itself is tied to the transaction, so it's easy to track the history of any single transaction through the system even for new fdForge users, and for experienced ones it's just a matter of minutes at all.

Future plans

After the already implemented financial module is tested for some time, we'll collect customer feedback, conduct our own internal analytics, and highlight the main objectives and plans for its future development. Currently, we're in an initial production run of the module; we're collecting feedback from our customers to make decisions on the implementation of the new functionality.

In future releases, we plan to include useful features such as:

- The ability to build various charts of financial statistics in the admin panel

- Building profit forecasts for specific account(s)

- Making plans and monitoring/forecasting these plans

- Financial module can be downloaded in report format

- Advanced analytics on accounts, transactions, transactions (charts, graphs, diagrams)

Conlusion

Our financial module can easily be described as “financial accounting with a human face” Instead of complicated documents and .xlsx files, the meaning of which can only be understood by accountants, the fdForge platform provides the user with a simple and clear picture of the project's financial flows. So the most important feature of the finance module is its visibility.

While the finance module is primarily a control tool for business management, the module's results are more effective interaction with customers and faster order processing for managers. The reason is simple – the status of all payments in the system is strictly tracked and available to the administrator at all times.

In the future, we'll try to keep you up to date with important updates to the platform, and we hope this article was helpful as a review of the new module and an understanding of the benefits of its functionality