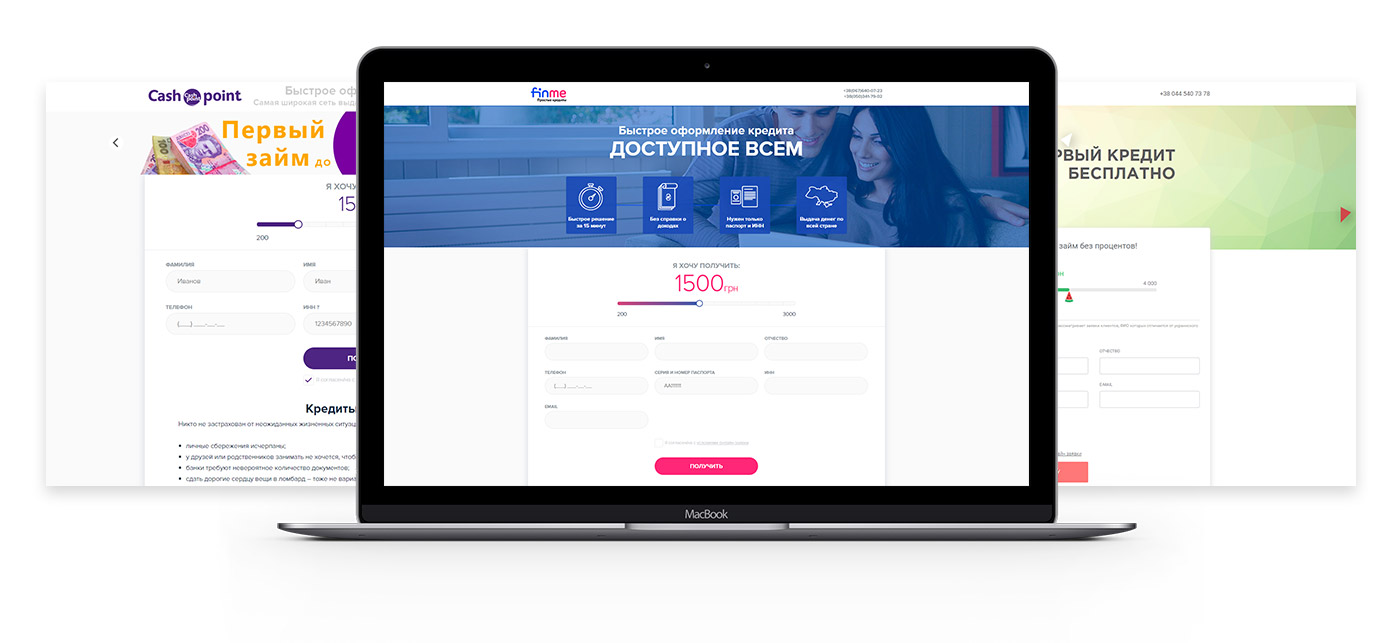

MFO (microfinance organizations), also known as payday loans, are services that specialize in offering short-term loans for 14-30 days. In the past few years, we had a chance to work on a number of similar services for different countries. That includes Cashpoint, a credit provider, Miloan.ua and Miloan.pl services, and a financial broker finme.ua, a system that finds a credit provider that suits the client’s requirements the most. Even though each region is specific due to the mentality of its people, state control of the field, sums and terms of loans, we concluded that it is possible to distinguish the factors that are identical for all microfinance websites and affect both website conversion and other things, such as user return rate (the second loan, the third, and so on), repayment indexes, etc.

We present the aspects of project development that should be taken into consideration first when implementing a microfinancing service.

MOBILE BROWSING

In our experience, most loan inquiries are made from mobile devices. When it comes to offline crediting (when a customer has to visit a company office in person), it is important for users to find directions to the nearest office. If it is an online service, the most important things are a well-designed form allowing to choose the terms of a loan, a clear registration form, and an interface for adding a credit card.

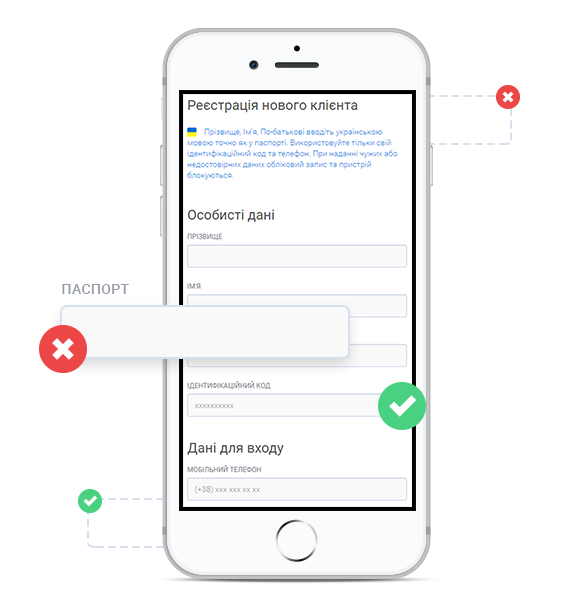

Changing the order of fields in a mobile form or a type of input for a field was enough for some projects to experience a 45-50% increase in conversion.

Changing the order of fields and input elements can significantly affect the mobile conversion rate. For example, changing the order of fields for the miloan.ua project (placing the birth date field under contact details) allowed to lower the number of typos when filling out the form significantly and, consequently, to lower the refuse rate for the applications.

THE EASE OF REPAYMENT

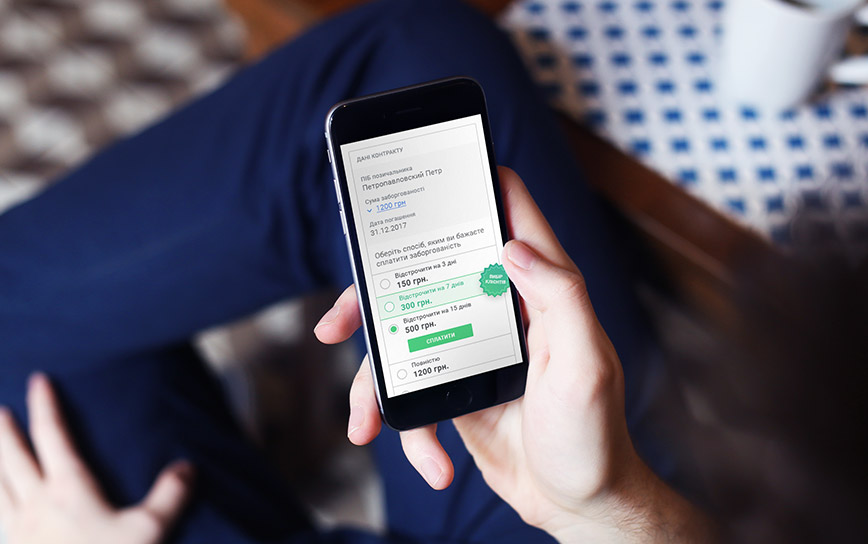

It is extremely important to offer a user as many channels and ways of repaying the loan as possible; in fact, we inserted the repayment link right into the notification letter in our projects; once a user follows this link, the sum of her loan and repayment options are displayed immediately.

This concern is relevant both for online services and MFOs that work in offline offices, since it is possible to repay the loan via a bank card even if it were originally provided in cash.

FRAUD PROTECTION

When developing financial services, it is necessary to pay special attention to protection against fraud. This matter is especially relevant when it comes to online microloan services, since you cannot see the customer in person.

It is essential to implement services that track user behavior to prevent fraudulent activities:

- Tracking the number of times users change their input when filling out an application, for example, to see if the user typed her Passport ID number immediately or tried a few combinations;

- Checking the data provided (checking if the birth date that the user provided matches the ID number);

- Requesting scans of the documents;

- Saving the device print of a user to cross-check it with other applications in the system.

Nevertheless, regardless of these actions, if there is suspicious activity spotted in the application, it should be passed over to manual handling.

THE BALANCE OF THE INFORMATIONAL CONTENT AND CONVERSION

It is necessary to have as few fields as possible, while collecting all the information required to ensure the protection against fraud. This is why it is extremely important to involve a Risk Management Team into the development of a minimal number of fields required to verify a user and provide a quality service to her; it is necessary to eliminate the potential road blocks for the user when filling out an application.

PARTNER INTEGRATIONS

The whole business is based on the generation of leads - the applications for loans are received from different sources and it is important to understand that one must be flexible when it comes to the integration of partner networks. Each network has its peculiarities and requirements for cross-checks and new applications. Also, there is a whole different subject of selling rejected applications. Sometimes, the applications from the people you are not ready to give a loan to can be sold to your competitors as leads, which allows you to process a larger number of applications.

MFO website traffic sources

SPECIAL OFFERS

The target audience of microloan services generally has a favorable reaction to special offers, such as lower interest rates, a day added to the loan term, or a steam cooker as a gift - all of these positively distinguish you from your competitors.

This is why it is important to plan for a possibility to implement and control such special offers at the stage of developing interface and software (goods and customers management system).

LOYALTY PROGRAMS

The first loan is unlikely to make up for the money spent on attracting a new customer. Hence, the main goal is to make the client return to you. This is why loyalty programs should be considered from the beginning.

For example, it is possible to offer the first loan at a 0% interest or to offer lower interest rates for regular customers. These involvement techniques are a gamification of a kind and they allow to attract users to your service and increase their return rate.

PROMOTION

Attracting audience is one of the main goals of the service. In this case, the main channels are:

- SEO - the cheapest, though inert, user acquisition channel that has to be dealt with from the beginning in order to receive the results as soon as possible.

- Content Marketing - another type of work to be done from the beginning, but the cost of attraction is higher;

- E-mail and SMS Marketing - comprises about 10% of the total traffic;

- Partner Programs - they were reviewed above. The cost of user acquisition depends on the agreements within partner networks, and what you are going to pay for, whether it is clicks, applications, or loans.

It is important to keep in mind that during the first stages of the functioning of the service, you are investing into the creation of a customer base - into users who will return to your service later.

LANDING PAGES

You will have to experiment in order to make the above-mentioned promotional techniques work effectively by changing your communication, the visual image, the way you present the information about the loan terms. It is necessary to develop a number of landing pages with changeable parameters in order to make such experiments in the most efficient and the least risky way.

CONCLUSION

Launching a microfinancing service is a complex process many parts of which can be automated. At the initial stage, you have to get a good idea of how you are going to organize your business, to draw a detailed plan, and select a number of tools and solutions based on which it will allow you to implement your plan.